Financials of Lucas Indian Service Limited

Financial Report - LUCAS INDIAN SERVICE LIMITED

Here is a summary of financial information of LUCAS INDIAN SERVICE LIMITED for the financial year ending on 31 March, 2023.- Revenue / turnover of LUCAS INDIAN SERVICE LIMITED is Over INR 500 cr

- Net worth of the company has increased by 15.71 %

- EBITDA of the company has increased by 3.63 %

- Total assets of the company has increased by 8.69 %

- Liabilities of the company has decreased by -1.90 %

Successfully added to cart.

| Operating Revenue | Over INR 500 cr |

| EBITDA | 3.63 % |

| Networth | 15.71 % |

| Debt/Equity Ratio | 0.00 |

| Return on Equity | 13.23 % |

| Total Assets | 8.69 % |

| Fixed Assets | 7.26 % |

| Current Assets | 6.61 % |

| Current Liabilities | -1.90 % |

| Trade Receivables | 10.44 % |

| Trade Payables | -5.33 % |

| Current Ratio | 1.68 |

* Company has reported to have approved financials for 31 March, 2023. However, in case, they are not available at MCA because of non-filing or damage, then we will provide the latest financials downloadable from MCA.

How to get financials of LUCAS INDIAN SERVICE LIMITED in Company360

Tofler Company360 provides access to any Indian company's financial documents, charts, ratio analysis and more. It lets you compare financials of several companies and study performance trends. These financials can also be downloaded in excel format. Here is the video showing how you can study the financials of an Indian company on the Company360 platform.

Company360 plans

Know more about your vendors, clients and competitors.

Financials, scores, ratios, excels, reports and more.

@ INR 9000/quarter

Join our newsletter

Charges on assets - LUCAS INDIAN SERVICE LIMITED

| CHARGE ID | DATE OF CREATION/ MODIFICATION |

MODIFIED | AMOUNT | CHARGE HOLDER |

|---|---|---|---|---|

| 10618222 | 09 September, 2015 | NO | 37.00 cr | HDFC BANK LIMITED |

| 10318471 | 21 January, 2013 | YES | 54.00 cr | ICICI BANK LIMITED |

| 90294299 | 28 March, 1996 | YES | 50.00 lac | THE HONGKONG SHANGHAI BANKING CORPORATION LTD |

| 90292220 | 03 June, 1995 | YES | 50.00 lac | THE HONG KONG SHANGHAI BANKING CORP LTD |

5 Biggest Charges

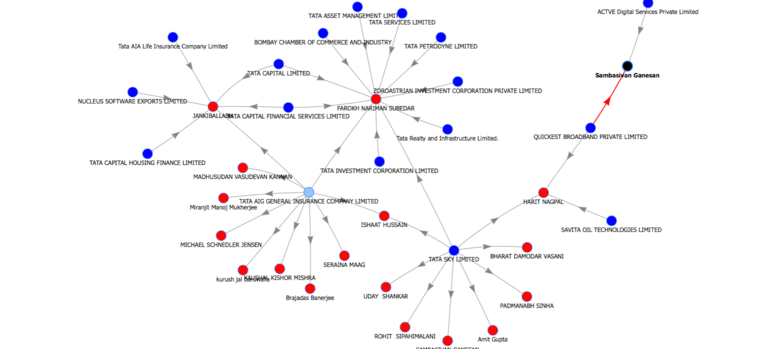

GROUP STRUCTURE - LUCAS INDIAN SERVICE LIMITED

Available in purchased financial report

Successfully added to cart.

FAQ - LUCAS INDIAN SERVICE LIMITED

-

What details can I find in the financial reports of LUCAS INDIAN SERVICE LIMITED?

The financial reports of LUCAS INDIAN SERVICE LIMITED include financial history (previous 5 Years), ratio analysis, management details such as directors & key persons of the company, shareholding & group structure details, mortgages & charges on LUCAS INDIAN SERVICE LIMITED.

-

What is the Operating Revenue of LUCAS INDIAN SERVICE LIMITED?

The operating revenue of LUCAS INDIAN SERVICE LIMITED is in the range of Over INR 500 cr for the financial year ending on 31 March, 2023.

-

What is the increase in EBITDA of LUCAS INDIAN SERVICE LIMITED since last year?

The EBITDA of LUCAS INDIAN SERVICE LIMITED has increased by 3.63 % over the previous year. At the same time, it's book networth has increased by 15.71 % for the financial year ending 31 March, 2023.

-

What is the price of financial reports of LUCAS INDIAN SERVICE LIMITED?

The price of financial report of LUCAS INDIAN SERVICE LIMITED prepared by Tofler is INR 799. It is an easy-to-read PDF report on the company that includes five year financial information, ratio analysis, management, group structure, shareholding pattern and more.

Subscribe to the Tofler Company360 program for complete access to Tofler's database. -

How to check Financial Reports of LUCAS INDIAN SERVICE LIMITED?

Follow 5 easy steps to download the balance sheet of LUCAS INDIAN SERVICE LIMITED:

1) Search for the company you require in the Tofler search bar

2) Select the financial reports in the Company Financials Section and add them to the cart

3) Confirm your email address on which you want reports to be delivered

4) Confirm & Checkout to Pay

5) Reports will be sent to your registered email address

Company360 plans

Know more about your vendors, clients and competitors.

Financials, scores, ratios, excels, reports and more.

@ INR 9000/quarter

Join our newsletter

Send e-mail

LUCAS INDIAN SERVICE LIMITED

Tofler, TWS Systems Private Limited and its officers respect the Intellectual Property Rights of all people. Tofler makes no claim of ownership or affiliation with any trademark (REGISTERED OR UNREGISTERED) that forms part of any Company/LLP name listed on this page. Trademarks, if any, listed on this page belong to their respective owners. Read More