Having introduced you to the tools and techniques of Financial Analysis, we will next look at the various Financial Statements on which these tools and techniques are applied. Among the various Financial Statements, we first take a look at the Balance Sheet

The Balance Sheet is a statement of the financial position of a company, and gives its state of financial affairs at a given point in time. Put simply, the Balance Sheet shows the sources from which the company has obtained its resources and the uses or ways in which these resources are being utilized. These two items will be equal to each other and hence, the term Balance Sheet.

The Balance Sheet is read and prepared in terms of Assets, Liabilities and Equity. It is based on the basic accounting equation:

In other words, Liabilities and Shareholders’ Equity are the sources of funds and Assets reflect the use these funds are put to.

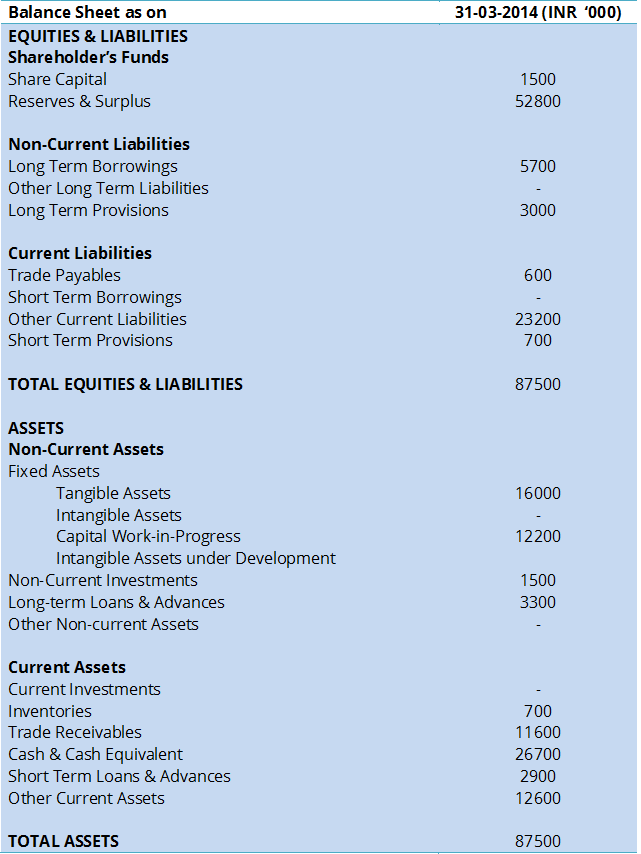

The following is a sample Balance Sheet of a company:

Assets are economic resources from which future benefits will be drawn. Future economic benefit may be in many forms, for example Cash is an asset and may be used to purchase goods and services, to pay back debts, to pay dividends, etc.; Plant and Machinery will enable the company to perform business activities and earn profit in the future; Trade Receivables will result in future cash flow from customers who bought products on credit, etc.

Liabilities are obligations payable to an individual or an organization outside the business. It includes any obligation that the company has incurred as a result of its past activities. For example, repayment to lenders for the money borrowed previously; warranty obligations that may become due in future and result in repair or refund to the customer; taxes that are payable, etc.

Shareholders’ Equity refers to the claim that the owners of a company have on the assets of the business. It represents the residual interest that the owners have in the assets of the company after all liabilities are deducted/ settled. Same can be inferred from rearranging the accounting equation:

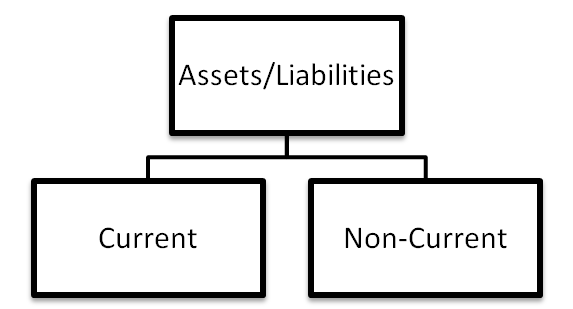

Classification of Assets and Liabilities

The assets and liabilities are further classified based on the length of time the asset or liability is expected to be consumed or expected to be repaid/satisfied by the business, respectively. Assets are classified as Current Assets and Non-Current Assets. Liabilities are classified as Current Liabilities or Non-Current Liabilities.

Assets may also be classified as tangible or intangible. Tangible assets are assets that have physical form, for example land, building, machinery, a truck, etc. Intangible assets lack any physical form, for example, trademarks, patents, copyrights, etc.

Current assets are assets that are expected to be consumed or converted to cash/ cash equivalent within a year or a normal operating cycle of the business if the cycle is longer than a year. Conversely, Non-Current assets will not be consumed or converted to cash within a year or a business operating cycle. They are expected to generate economic benefits over more than one year. In effect, what this means is that Current Assets are more liquid than Non-Current Assets. We will explore liquidity in further detail in the articles to come.

To illustrate, Inventories are current assets reported in the balance sheet. Inventories are goods held for Sale or used in manufacture of goods to be sold. On the other hand, Land and Building, Plant and Equipment are Non-Current Assets unless the company is in the business of selling land, building, plant or machinery.

Similarly, Current Liabilities are liabilities that will fall due within a year or the operating cycle. Non-Current Liabilities will fall due after a year or an operating cycle completes.

For Example, Trade Payables, which are amount the firm owes to its suppliers for products purchased on credit, are current liabilities. Long Term Bank loans are non-current liabilities.

Shortcomings

Balance Sheet analysis is required everywhere one has to deal with companies. The extent to which it is analyzed, though, may differ. However, there are certain shortcomings associated with the balance sheet. The Balance Sheet is prepared at a point of time and the values reflected are the historical values. For example, land once purchased is always reflected at the historical cost, whereas the price of the same land would appreciate over a period of time. Also, the balance sheet will only capture assets acquired in transactions. Hence, human capital, goodwill, etc. which are difficult to value, are not reflected in the Balance Sheet as they are not acquired from another company.

Nonetheless, a sound understanding of the Balance Sheet is a must to carry out the financial analysis.

Next in the Series is the Income Statement, also known as the Profit and Loss Account.

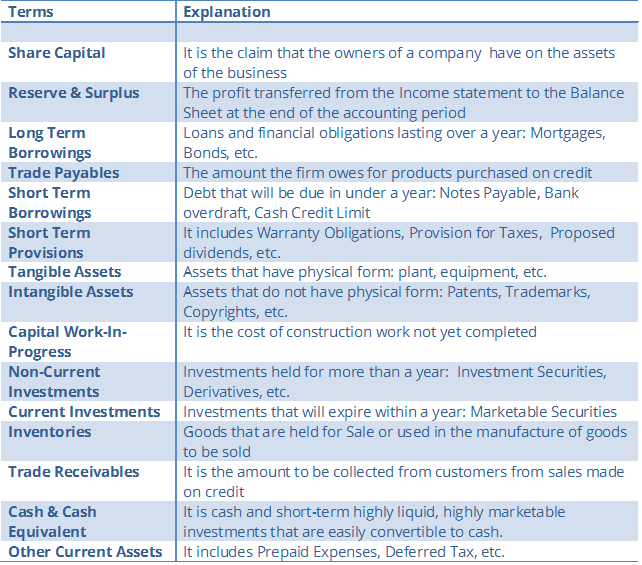

A brief look at a few key terms occurring in the Balance Sheet

Author – Vishal, a recent addition to Team Tofler, combines his passion of writing with searching for a worthy story in a Company, to make an interesting read.

Editor – Anchal, founder at Tofler, is a CA, CS and has more than 5 years experience in company analysis. She likes to explore and track companies, their performance and senior management.