Are you really sure about who you’re doing business with?

Every business relationship is built on trust — but smart businesses verify before they commit. Whether you’re vetting a potential supplier, evaluating a customer’s payment reliability, or considering a partnership, knowing the true health and integrity of a company can save you from costly mistakes.

The good news? There’s a single metric designed to give you this insight at a glance: The Tofler Score.

What Exactly Is the Tofler Score?

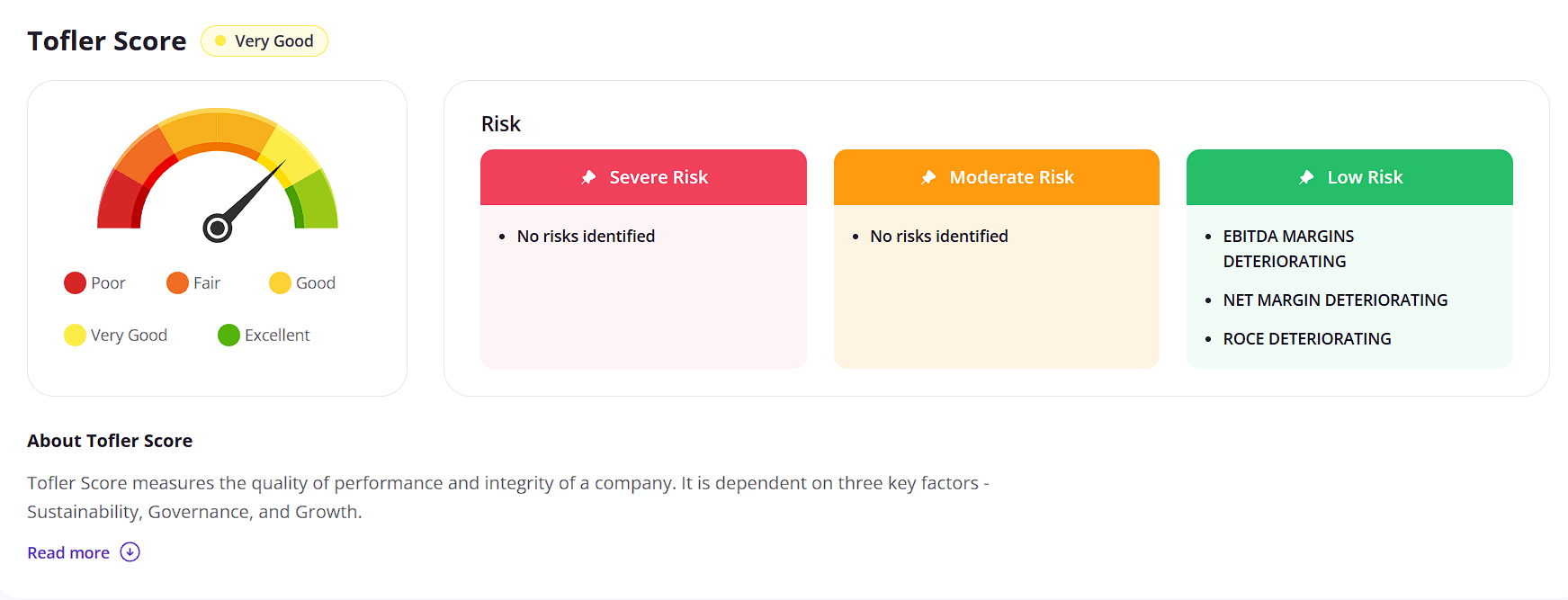

Think of the Tofler Score as a comprehensive health check for businesses. It measures both the performance quality and integrity of a company on a scale of 0-100, giving you an immediate sense of whether a business is worth your time, money, and trust.

A company with a high Tofler Score is likely to:

- Grow strong and sustainably

- Pay creditors and suppliers on time

- Complete compliance requirements properly

- Operate with integrity among its industry peers

But what makes this score truly valuable is that it’s not just looking at a single dimension of business health — it examines three critical factors that together provide a complete picture.

The Three Pillars of the Tofler Score

1. Sustainability (35% weight)

This measures the overall financial health of the company. It’s not just about having money in the bank — it’s about how effectively a business manages what it has.

What it evaluates:

- Profitability trends

- Return on assets and capital

- Liquidity position

- Solvency indicators

- Working capital efficiency

- Performance volatility across years

- Quality of assets and liabilities

Why it matters: A company with high sustainability scores deploys its assets effectively, maintains tight operational controls, and grows profitably. Most importantly, it can consistently pay suppliers, creditors, and lenders on time — which might include you.

2. Trustworthiness (35% weight)

While numbers don’t lie, they don’t always tell the complete truth. The trustworthiness component looks beyond the financials to assess a company’s integrity.

What it evaluates:

- Compliance with TDS, GST, and other legal requirements

- Potential conflicts of business interest

- Presence on defaulter lists

- Financial statement consistency

- Connections to non-compliant or defaulting companies

- Directorship conflicts

- Registration details and location

Why it matters: A trustworthy company operates professionally, stays compliant, maintains distance from tainted entities, doesn’t manipulate its financials, and generally runs clean operations. In short — they’re less likely to cause you headaches down the road.

3. Growth (30% weight)

The final component assesses how fast the company has been growing and, crucially, whether that growth is sustainable.

What it evaluates:

- Income growth trajectories

- Profitability trends

- Employee expansion

- Asset growth

- Sustainability of current growth rates

Why it matters: The growth component distinguishes between genuine business expansion and manipulated or unsustainable growth spikes. It helps you identify companies that are truly on an upward trajectory rather than those creating a temporary illusion of success.

Making Sense of the Score

Understanding what the number means is straightforward:

| Score Range | Rating |

| Less than 30 | Poor |

| 30 – 45 | Fair |

| 45 – 60 | Good |

| 60 – 80 | Very good |

| 80 – 100 | Exceptional |

When Should You Check a Tofler Score?

The Tofler Score becomes particularly valuable when:

- Evaluating new suppliers: Will they consistently deliver, or disappear with your advance payment?

- Assessing customer creditworthiness: Before offering generous payment terms, check if they’re likely to honor them.

- Considering partnerships: Their business practices and financial health will directly impact yours.

- Competitive analysis: How do your peers measure up? Where do you stand in comparison?

- Investment decisions: Before putting money into a business, understand its true health beyond the pitch deck.

Beyond the Score: Digging Deeper

While the Tofler Score gives you a quick assessment, the detailed breakdown offers even more value:

- Sub-score comparisons: Is the company financially solid but with questionable compliance? Or trustworthy but financially struggling?

- Industry benchmarking: How does this company compare to others in the same sector? What’s normal for your industry?

- Trend analysis: Is their score improving or declining over time? A downward trend might signal emerging problems.

Final Thoughts: Smart Business Is Informed Business

In today’s complex business environment, gut feelings and reputation aren’t enough to base decisions on. The Tofler Score offers a data-backed approach to assessing business relationships before you commit.

It’s not about avoiding every company that isn’t perfect — it’s about understanding the risks you’re taking and managing them appropriately. Maybe you’ll still work with a company with a lower score, but with modified payment terms or additional safeguards.

Don’t rely on assumptions or outdated information. Use objective, comprehensive data to make smarter business decisions.

Remember: Trust is good. Verification is better. The Tofler Score gives you both.

Note: The Tofler Score is not a credit rating and doesn’t have approval from any statutory or regulatory body. It represents Tofler’s unbiased opinion on a company’s performance and state of affairs.