Bank Nifty represents the 12 most liquid and large capitalized stocks from the banking sector that trade on the National Stock Exchange (NSE). It provides investors and market intermediaries with a benchmark that captures the capital market performance of the Indian banking sector.

NIFTY Bank Index is computed using the free float market capitalization method. NIFTY Bank Index can be used for a variety of purposes such as benchmarking fund portfolios, and launching of index funds, ETFs and structured products.

What are the eligibility criteria for the selection of constituent stocks:

- Companies should form part of NIFTY 500 at the time of review. In case, the number of eligible stocks representing a particular sector within NIFTY 500 falls below 10, then the deficit number of stocks shall be selected from the universe of stocks ranked within the top 800 based on both average daily turnover and average daily full market capitalization based on previous six months period data used

for index rebalancing of NIFTY 500. - Companies should form a part of the Banking sector.

- The company’s trading frequency should be at least 90% in the last six months.

- The company should have a listing history of 6 months. A company that comes out with an IPO will be eligible for inclusion in the index if it fulfils the normal eligibility criteria for the index for a 3-month period instead of a 6-month period.

- Companies that are allowed to trade in the F&O segment are only eligible to be constituents of the index.

- Final selection of 12 companies shall be done based on the free-float market capitalization of the companies.

- Weightage of each stock in the index is calculated based on its free-float market capitalization such that no single stock shall be more than 33% and the weightage of the top 3 stocks cumulatively shall not be more than 62% at the time of rebalancing.

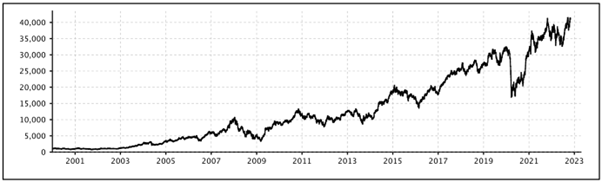

Bank Nifty value from year 2001:

Here is the list of Top constituents by weightage:

| Company’s Name | Weight(%) |

| HDFC Bank Ltd. | 25.61 |

| ICICI Bank Ltd. | 24.62 |

| Axis Bank Ltd. | 12.63 |

| State Bank of India | 10.99 |

| Kotak Mahindra Bank Ltd. | 10.87 |

| IndusInd Bank Ltd. | 5.57 |

| AU Small Finance Bank Ltd. | 2.08 |

| Bank of Baroda | 2.06 |

| Federal Bank Ltd. | 1.97 |

| Bandhan Bank Ltd. | 1.35 |

Source: https://www1.nseindia.com/

To know more about the banks listed above, explore the buying financial options here.

FAQs for Bank NIFTY index

Q1. What is Bank Nifty?

Ans. Nifty Bank, or Bank Nifty, is an index comprised of the most liquid and large capitalised Indian banking stocks.

Q2. What is Nifty full form?

Ans. The full form of NIFTY is the National stock exchange FIFTY.

Q3. What is nifty formula?

Ans. The market value is divided by the base market capital multiplied by the base value of 1,000 to determine the index value of Nifty daily. The formula for calculating

Formula of Nifty Index:

Market Capitalisation = Equity Capital X Share Price

Q4. How can I buy Nifty?

Ans. There are two ways to invest in NIFTY 50.

- Buy stocks directly in the same percentage as their weightage in NIFTY 50.

- Invest in Index Mutual Funds that track NIFTY 50.