Credit rating is a numerical assessment of a company’s creditworthiness, measuring the likelihood of it defaulting on its debt. It represents an attempt to estimate the level of risk involved in investing in or lending money to a particular business or other entity.

What is a Credit Rating?

Credit rating is an assessment of the creditworthiness of a borrower in general terms or with respect to a particular debt or financial obligation. It is an evaluation made by credit rating agencies of the credit risk of a bond issuer or a financial instrument.

A high credit rating indicates that, in the opinion of the rating agency, a borrower is likely to repay its debts without difficulty. A poor credit rating suggests that it might struggle to keep up with its payments or even fail to make them. Credit ratings are usually expressed using letters, such as AAA to D. Wherein AAA stands for the highest, and D is considered as the lowest.

Credit rating is an important aspect of the financial world that helps businesses evaluate their creditworthiness. In India, credit rating agencies assess the creditworthiness of businesses based on various factors such as financial statements, credit history, and other factors. The credit rating assigned by these agencies helps lenders and investors evaluate the risk associated with lending money to that business and make informed decisions regarding investment, lending, and risk management.

The highest rating in India is AAA. Financial instruments with an AAA rating are the ones that have the least risk. Moreover, the companies issuing these financial instruments are less likely to default on their payments. Hence the interest rate or rate of return on these instruments is low.

What are Credit Rating Agencies?

There are a total of seven credit agencies authorized by the Securities and Exchange Board of India (SEBI) in India viz, CRISIL, CARE, ICRA, SMREA, Brickwork Rating, India Rating, and Research Pvt. Ltd, and Infomerics Valuation and Rating Private Limited. Here is a brief introduction to each of the seven credit rating agencies in India:

CRISIL: Credit Rating Information Services of India Limited (CRISIL) is India’s first credit rating agency. It was established in 1987 and is headquartered in Mumbai. CRISIL provides ratings for debt instruments issued by companies, banks, financial institutions, and governments.

CARE: Credit Analysis and Research Limited (CARE) is a credit rating agency based in Mumbai. It was established in 1993 and provides ratings for debt instruments issued by companies, banks, financial institutions, and governments.

ICRA: ICRA Limited (formerly Investment Information and Credit Rating Agency of India Limited) is a credit rating agency based in Gurgaon. It was established in 1991 and provides ratings for debt instruments issued by companies, banks, financial institutions, and governments.

SMREA: SMERA Ratings Limited (SMERA) is a credit rating agency based in Mumbai. It was established in 2005 and provides ratings for small and medium enterprises (SMEs), microfinance institutions (MFIs), and infrastructure projects.

Brickwork Rating: Brickwork Ratings India Private Limited is a credit rating agency based in Bengaluru. It was established in 2007 and provides ratings for debt instruments issued by companies, banks, financial institutions, and governments.

India Rating and Research Pvt. Ltd: India Ratings and Research Private Limited (Ind-Ra) is a credit rating agency based in Mumbai. It was established in 2007 as a joint venture between the Fitch Group and the Industrial Development Bank of India (IDBI). Ind-Ra provides ratings for debt instruments issued by companies, banks, financial institutions, and governments.

Infomerics Valuation and Rating Pvt. Ltd: Infomerics Valuation and Rating Private Limited is a credit rating agency based in Mumbai. It was established in 1995 as Infomerics India Limited. Infomerics provides ratings for debt instruments issued by companies, banks, financial institutions, and governments.

Factors that go into Credit Ratings

The process of credit rating involves qualitative and quantitative assessment of the organization. It shows the risk associated with investing in debt instruments. Hence this gives investors a clear picture to make clear decisions. Moreover, it also helps companies to raise money to finance their projects.

When evaluating credit ratings, various factors are taken into account by credit rating agencies, each employing their unique methodologies. Here are several key factors that typically hold significant influence over a company’s credit rating:

- The quality of the underlying asset that is provided as collateral for the subject security

- Credit obligations and repayment histories with lenders and suppliers

- Legal filings such as tax liens, judgments, or bankruptcies

- How long the company has operated

- Business type and size

- Repayment performance relative to that of similar companies

- Payment history including any missed payments or defaults

- The amount they currently owe and the types of debt they have

- Current cash flows and income

- The market outlook for the company or organization

- Any organizational issues that might prevent timely repayment of debts

- Consistent Free Cash Flows (FCFs)

- High-profit margins (e.g. Gross Profit Margin, Operating Margin, EBITDA Margin, Net Profit Margin)

- Track record of timely debt payments

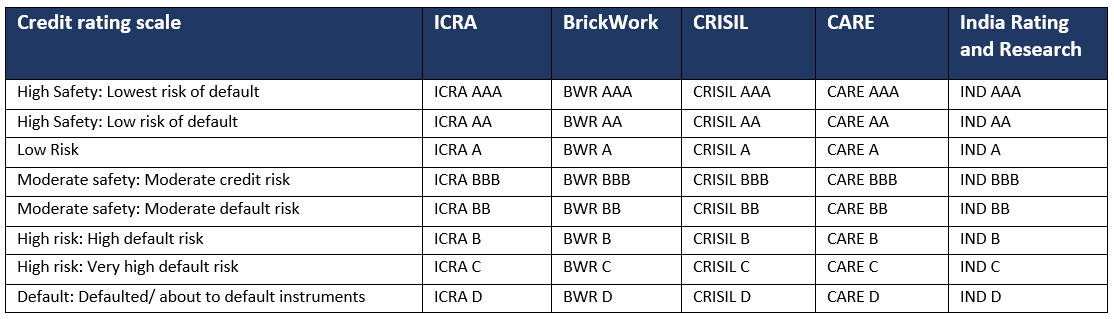

Credit Rating Scales Used by Various Credit Rating Agencies in India

Credit rating agencies play a crucial role in assessing the likelihood of default by companies or governments that have borrowed money. They utilize the aforementioned factors to evaluate the potential risks involved. By assigning probabilities to these events, they assign credit ratings on a scale ranging from AAA to D.

Note: A plus (+) or minus (-) sign may be appended to the above ratings to indicate relative standing within each rating category. Example: AAA+ is a higher rating than AAA.

Gaining a fundamental understanding of credit ratings in India is crucial for anyone involved in the financial landscape. By comprehending the factors considered by rating agencies and the significance of credit ratings, individuals can make informed decisions, mitigate risks, and navigate the Indian market more effectively which empowers you to navigate the intricate world of credit assessment with confidence and clarity.